Number plate investment

You may be buying your personal number plate to personalise your car, to hide its age or simply as a bit of fun, but did you know that you may also be investing in something that will bring you a nice profit should you decide to sell it in the future?

A genuine investment in a healthy market

Private number plates, once an elitist flourish seen only on the luxury cars of the rich and famous, have become a universally popular way for car owners to personalise their vehicles.

There is still exclusivity at the high end of the market but people now realise that there is a wide choice available, with something to suit every budget.

This growing popularity has driven the growth of a multimillion-pound industry around the buying and selling of car registrations. Spectacular sale prices frequently make the news and every number plate auction seems to produce at least one record-breaking or headline-grabbing sale.

Since it began selling personalised registrations in 1989, The DVLA has sold a staggering 6 million registrations. Recent data shows that the British public owns a staggering £4.3 Billion worth of private number plates and personalised plates are now taken into account as assets when bodies such as the Office for National Statistics calculate the UK's national wealth [1].

How do private number plates compare with traditional investments?

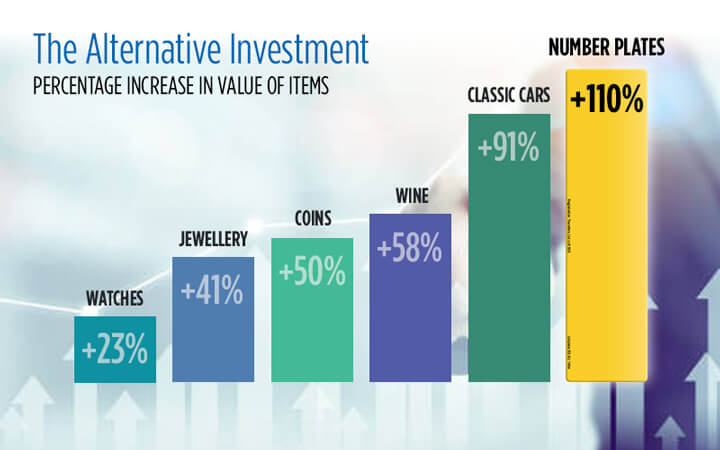

In recent years, alternative investments such as classic cars, wine, jewellery etc have consistently gone up in value and have often outperformed traditional stocks and bonds.

The value of private registrations over the same period has shown a similar trend. Actually, in percentage appreciation terms, top quality private registrations have performed even better than classic cars, antique furniture, watches, wine, art or jewellery.

Here are just a few examples that show how much the value of registrations can grow.

| Registration | 1st sale | 2nd sale | Overall Increase |

|---|---|---|---|

| 1 AJT | £35,000 (2014) | £72,000 (2021) | 106% |

| 1 BNK | £8,900 (2014) | £75,000 (2021) | 743% |

| 1 DRB | £30,000 (2013) | £90,000 (2021) | 200% |

| 1 KFH | £14,000 (2012) | £55,000 (2017) | 293% |

| 1 AMP | £22,000 (2008) | £66,000 (2010) | 200% |

| 15 A | £44,891 (2016) | £70,000 (2017) | 56% |

| 86 G | £27,000 (2019) | £68,620 (2021) | 154% |

| 97 J | £20,150 (2017) | £55,000 (2018) | 173% |

| 321 J | £11,250 (2017) | £21,495 (2019) | 91% |

| J 541 | £8,000 (2018) | £14,495 (2020) | 81% |

| M4 RKG | £15,500 (2013) | £60,000 (2015) | 287% |

| G11 LES | £10,495 (2008) | £33,500 (2014) | 219% |

| E111 OTS | £11,890 (2011) | £29,000 (2014) | 144% |

| CRA 16A | £7,000 (2018) | £10,200 (2021) | 46% |

| BLA 6K | £8,588 (2008) | £17,000 (2019) | 98% |

| 81 VY | £4,000 (2018) | £17,000 (2021) | 325% |

| DN11 CKY | £1,392 (2015) | £4,300 (2016) | 209% |

| LAU 124M | £2,500 (2016) | £5,895 (2020) | 136% |

| RC14 ARD | £1,373 (2017) | £3,000 (2019) | 119% |

| 2 TL | £20,000 (2020) | £40,000 (2020) | 100% |

| 4 KM | £26,500 (2017) | £60,000 (2019) | 126% |

| 11 US | £7,000 (2018) | £17,495 (2021) | 150% |

| 32 SA | £8,120 (2018) | £15,500 (2020) | 91% |

| 48 MH | £15,000 (2020) | £26,000 (2021) | 73% |

| 83 SP | £11,000 (2019) | £21,000 (2021) | 91% |

| 94 RB | £15,500 (2019) | £25,000 (2021) | 61% |

| SB 90 | £24,000 (2018) | £35,000 (2021) | 46% |

| 765 LT | £8,208 (2019) | £30,000 (2021) | 266% |

| 666 RS | £8,500 (2009) | £23,367 (2021) | 175% |

| 888 DP | £9,000 (2007) | £16,000 (2013) | 78% |

| 911 CC | £6,850 (2007) | £17,000 (2015) | 148% |

| DL 1001 | £3,500 (2018) | £6,995 (2019) | 100% |

| 7 JDC | £8,600 (2010) | £17,500 (2016) | 103% |

| 5 MCD | £16,000 (2007) | £29,000 (2014) | 81% |

| 4 ART | £8,400 (2008) | £35,000 (2016) | 317% |

| 8 UXA | £1,400 (2018) | £6,500 (2020) | 364% |

| 8 UFX | £1,595 (2018) | £5,170 (2019) | 224% |

| CBS 4 | £5,336 (2018) | £10,800 (2020) | 102% |

| MCC 7 | £8,495 (2016) | £15,500 (2019) | 82% |

| CUM 2 | £2,500 (2016) | £20,000 (2020) | 700% |

| 9 JMM | £9,500 (2017) | £17,495 (2020) | 84% |

| HKR 11 | £4,000 (2018) | £15,000 (2019) | 275% |

| 11 BDG | £2,800 (2017) | £8,400 (2021) | 200% |

| 16 RAB | £5,000 (2016) | £13,000 (2020) | 160% |

| AAS 10 | £3,836.67 (2016) | £16,072 (2021) | 319% |

| ALF 13 | £16,000 (2016) | £57,500 (2017) | 259% |

| LSH 111 | £5,000 (2016) | £8,250 (2019) | 65% |

| GTS 333 | £3,200 (2017) | £6,250 (2019) | 95% |

| 911 MCB | £4,500 (2016) | £8,600 (2021) | 91% |

| 120 WEN | £2,000 (2014) | £5,000 (2015) | 150% |

| 815 HOP | £3,607 (2008) | £10,000 (2010) | 177% |

| CAS 51N | £4,000 (2019) | £12,500 (2021) | 213% |

| JOS 11B | £4,000 (2015) | £8,600 (2020) | 115% |

| CRE 11D | £2,500 (2017) | £7,000 (2020) | 180% |

| HAR 180N | £2,750 (2016) | £7,000 (2019) | 155% |

| G1 BSO | £1,836 (2017) | £5,000 (2021) | 172% |

| M2 BAD | £2,300 (2016) | £6,150 (2019) | 167% |

| M3 WON | £1,595 (2016) | £5,995 (2017) | 276% |

| R8 TOY | £1,500 (2015) | £6,250 (2016) | 317% |

| T4 OMS | £1,700 (2020) | £5,000 (2021) | 194% |

| P14 STA | £3,250 (2018) | £7,750 (2020) | 138% |

| A999 RON | £1,550 (2017) | £4,000 (2018) | 158% |

| AY55 HAA | £1,500 (2015) | £9,800 (2019) | 553% |

| HS61 NGH | £2,000 (2016) | £4,000 (2018) | 100% |

What makes a good investment number plate?

There are a number of factors that contribute to the value of a private registration number and, thus, to its investment potential.

Here are some of them:

-

Supply vs demand

Certain types of number are prized for their rarity and the prestige associated with them. Number 1 plates are a good example as they are regarded as being amongst the most desirable private plates. This demand combined with their limited availability means that they command high prices.

-

Visual impact

Some number plates have immediate visual impact. Single-letter number 1 number plates always attract attention. Very clear spellings of names and words are also very eye-catching

-

Clarity/accuracy of representation

How closely a combination resembles the name or word it is supposed to represent is an important consideration. There are usually only one or two possible ways to spell a word almost perfectly on a number plate: W4 TER or WAT 3R to represent "water", for example . Other, less accurate, renderings such as W47 TER or WAT 33R decrease in value as they become less instantly readable. Scarcity of available representations can, however, offset this to an extent.

-

Popularity of initials

In the UK, there is clearly a much larger potential market for the more commonly used initials JS than for the rarer initials XZ. There is, therefore, likely to be more competition for JS combinations, which may be reflected in a higher price.

-

Fame

If a number plate has been closely associated with a famous person then its value may be boosted somewhat by the connection.

-

Fashion/trends

In recent years we have seen a number of number plates bought and sold on the strength of their relevance to cryptocurrency and other cultural phenomena. Combinations such as BTC (for "Bitcoin") have performed strongly in auctions. We have also seen internet and social media themed number plates do well.

How to choose your investment number plates

We cannot give specific financial or investment advice but we can offer a few tips to bear in mind when considering possible investment purchases.

Some of these follow logically from the items listed above as contributors to value. Others are practical points to bear in mind when purchasing number plates in general.

-

Have a market in mind

Before buying plates, have an idea of who may want to buy them. Some plates will have broad appeal because they are short, or because they are of an inherently desirable type, such as the number 1 plates we mentioned above. Others, will have a narrower, but equally strong appeal to a more specific audience (names and initials, for example).

-

Research your market

When you have an idea of who might be interested, try to find out a little more about the sales potential. There are websites and other resources that will give you an idea of how many people in the country have a certain name. If you want to appeal to cryptocurrency adopters, learn the most widely used and reliable currencies and then look for their abbreviations in available number plates combinations.

-

Follow trends and learn from history

If there has been a very recent sale of a registration that's very similar to one in your investment portfolio, take that into account when assessing the potential value of your plate. Similarly, use recent sales to give an idea of what kinds of number plates are currently selling well. There are noticeable trends that crop up from time to time. We often comment on these and other aspects in our regular DVLA auction reports. Check those regularly to keep up to date with what's happening.

-

Understand the red tape

The bureaucracy surrounding number plates can work for or against you. Some of it is very useful: DVLA's retention scheme allows you to purchase and keep registrations in the form of certificates, even if you don't have vehicles to assign them to. You may buy as many registration numbers as you wish, without having to worry about MOTs, road tax etc.

On the other hand, it is important to ensure that you complete all paperwork completely accurately. Errors in names or addresses given when buying numbers can be difficult and costly to correct later. One should also bear in mind that number plate certificates have expiry dates. Be sure to renew your certificates promptly to avoid any risk of losing your registration numbers.

Who buys?

There is no shortage of millionaire and entrepreneur owners of private car registrations. These astute people earned their reputations and their fortunes by investing wisely. Here are just a few of the successful people who have come to Regtransfers for their private registrations: you will know their names.

Duncan Bannatyne

of Dragons' Den

Theo Paphitis

of Dragons' Den

James Caan

of Dragons' Den

George Bamford

Founder of Bamford Watches

Kelly Hoppen

of Dragons' Den

Sir John Madejski

Founder of Autotrader

The bottom line

Unlike a car, a private registration holds its value very well indeed. Furthermore, a well-chosen registration may bring a genuine investment benefit and, ultimately, a very tidy profit!

Let's find yours!

Our sales advisors are available to help you find your perfect number plate.

And they are rather good at finding great combinations that you've never thought of.

Call us on 01582 967777, 9am - 9pm, 7 days a week.

Footnotes:

- Sources: BBC article How wealthy are you? and the ONS website

- For the purpose of this analysis, we examined all our sales of two letter, number one private number plates between 2012-2017.

- Source for all other assets: Knightfrank.com Luxury Investment Index